In Brief

A decade ago, on a convention center stage in San Francisco, Steve Jobs debuted the first Apple iPhone. In the years since, mobile devices re-engineered how we shop, consume media, travel, manage our health and do our banking, among countless daily rituals.

The smartphone’s rise to dominance is one example of the power innovative technology wields. Technological advances — in the form of not only powerful tools and products, but also new processes and delivery models — have rattled organizations far beyond Silicon Valley.

No industry is immune from technology’s disruptive grip. Incumbents across sectors feel the heat from startups and digital giants alike. Business leaders, whether you see this disruption heading your way or are knee-deep in it and feeling the financial impact, need to act quickly.

Disruption's Ripple Effect (It's Wider Than You Think)

Most conversations around tech disruption stop at its primary and secondary impacts: E-commerce sparked the retail “apocalypse;” online streaming instigated the age of cord-cutting; ride-sharing is upending the car rental industry.

But the effects of disruption spread beyond its initial victims. Its after-effects often reverberate into secondary and tertiary markets.

| First, Second and Third-Order Effects of Disruption | |

|---|---|

| Exhibit A: Tesla | Exhibit B: Amazon |

|

The San Francisco-based automaker is on a mission to make electric vehicles (EV) mainstream (by some accounts, they're making waves.) Traditional auto manufacturers, however, won't be the only business to feel the heat.

|

The internet behemoth is on pace to command almost 44 percent of U.S. e-commerce sales and has a market value greater than that of Walmart, Target and a handful of department stores combined.

|

The pace of innovation shows no signs of slowing. Venture capital funding continues to flow at a record clip, with 2017 shaping up to be a fourth consecutive year of more than $40 billion in commitments. Nearly 300,000 U.S. patent applications were filed in 2015, a nearly 40 percent increase from 2005 and 68 percent increase from 1995.

For incumbent organizations, doing nothing isn’t an option. Quite the contrary, business leaders need to prepare for and push their companies through short and long-term change.

Situational Analyses No Longer So Straightforward

Even in an era of disruption, a situational assessment is step one toward mapping out the transformations your organization should pursue. The challenge for management teams is navigating two distinct paths of evolution:

- Today: To start, leaders must reposition their existing companies to survive in the current competitive landscape. This involves doubling down on optimizing the performance of the current business, focusing on core competencies and shedding waste.

- Tomorrow: At the same time, companies have to play the long game. Efforts should be invested in identifying new business models and markets to create opportunities that will transform the organization for years to come.

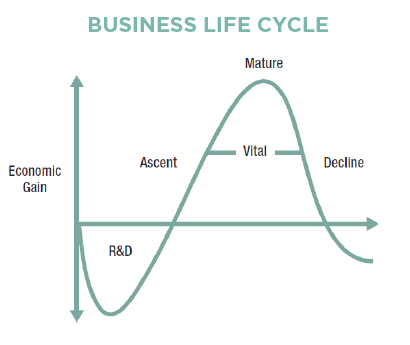

To fulfill these dual objectives, situational analysis must start with pinpointing where your organization falls on the business life cycle.

It wasn’t unusual for organizations to enjoy decades at peak maturity. But the force of the “Frightful Five” tech giants (not to mention the startups they’ve spawned) is pushing legacy businesses into decline faster than ever. Today, organizations across the automotive, energy, healthcare, higher education and retail industries are all fighting against this downward slide.

The next step in the situational assessment is evaluating all competitive threats to narrow down your options for transformation. Thanks to technology, it’s much more difficult to see whose R&D efforts are putting your operations at risk.

Increasingly, competitors (be they known or unknown) emerge across industry lines. Auto manufacturers no longer compete only with each other or Tesla; they also face headwinds from ride-sharing services and the myriad tech companies embroiled in the race to autonomous vehicles.

Health systems and hospitals face an equally diverse competitor landscape. Aside from vying for patients with other care providers (e.g., in-home services, specialty labs and clinics), they’re contending with a growing class of telemedicine platforms and startups focused on care quality and cost transparency.

Related Article: Zero-Based Budgeting 2.0

A focused approach and the use of technology can simplify the process and yield big benefits to large and smaller companies alike.

Read More

Repositioning Your Business Today

The output of your situational assessment should act as a guide to assembling the right turnaround plan. When it comes to the first phase of transformation, there are a variety of ways to enhance core operations in the near term.

It’s worth highlighting that shoring up your business today is not simply an act of getting back to basics — particularly if your “basics” are under siege. Consider the different approaches management and boards may vet to jumpstart a turnaround:

- Evaluate product profitability: Delineating profitable and unprofitable products or product lines through contribution margin analysis creates a compass for where to allocate resources, and sheds light on potential pricing issues and divestitures. This exercise forces leaders to classify “core” versus “non-core” products, and think through customer attrition rates to forecast how changing customer preferences will impact future cash flow. The results of this analysis may include outsourcing certain production processes, “firing” unprofitable customers or optimizing revenue streams.

- Divest non-core business lines: Product profitability assessments often call out opportunities to eliminate non-core, underperforming or overvalued assets. Divesting particular units can shore up revenue today and generate liquidity to support future strategic initiatives.

- Rationalize headcount: Leadership teams can be quick to make performance improvement synonymous with force reduction. Eliminating staff in the name of cost-cutting, however, may come at the expense of future product innovation. In addition to thinking through current headcount, consider the new skills you’ll need in house to execute the turnaround plan.

- Assess your sales model: The direct sales strategy that served your business well in past decades doesn’t have to be the only option going forward. Building channel relationships can facilitate cost savings, albeit with a slight loss of control over the sales cycle and revenue predictability. As new offerings from Cadillac and Hyundai illustrate, subscription or “as-a-service” models are also gaining traction far beyond the software realm.

- Review your management team and incentives: Leadership during a turnaround is essential. Thriving through disruption demands people who can make (and defend) bold choices, as well as manage the friction between teams tasked with stabilizing the business today and executing tomorrow’s vision. This may necessitate retooling incentive plans for leadership and sales teams alike to reflect the new normal.

- Vet acquisition and partnership opportunities: Beyond operational improvements, mergers, acquisitions and partnerships should be carefully considered. Tremendous value could be realized by joining forces with companies outside of your traditional sector — a path many incumbents are already pursuing, such as Fiat-Chrysler and Google (which are collaborating on in-vehicle tech) and Kohl’s (which recently began accepting Amazon returns and selling Amazon devices).

The speed of tech innovation warrants quick and decisive action, not to mention an objective point of view, from all business leaders. Legacy organizations that take a proactive, deliberate approach to transformation will be positioned to thrive amid disruption rather than be defeated by it.