In Brief

As the digital revolution extends into its second decade, it is becoming increasingly evident that the industrial sector is lagging well behind consumer-focused businesses like financial services in terms of game-changing applications of digital technology. The terms “industry 4.0” and “industrial Internet of Things (IIoT)” gained popularity in the mid-2010s, and there are some exciting examples of progress out there among manufacturers and other business-to-business players. However, leaders are becoming increasingly frustrated with the ability of their organizations to make progress on the promised digital transformation in a way that drives significant business impact.

Summary

- Many industrial and manufacturing companies are lagging behind other industries in their digital transformations.

- Industrial and manufacturing companies should prioritize digital transformation to remain viable in a disrupted market.

- Establishing a clear understanding of the future environment as well as a vision for the company’s role within it helps build a strong foundation for industrial and manufacturing companies’ digital strategies.

This is disappointing, especially considering the outsize potential that digital transformation holds within the industrials space and the fact that many of these companies have already allocated significant capital to these projects. In late 2020, the International Data Corporation (IDC) predicted that global spending on digital transformation would top out at $6.8 trillion by 2023, and a Gartner survey found that 82% of chief financial officers across industries plan to increase their investments in technology this year.

There are certainly a number of challenges that industrial and manufacturing companies face when executing and sustaining digital transformations, but the lack of a clear strategy is often the primary culprit.

There are certainly a number of challenges that industrial and manufacturing companies face when executing and sustaining digital transformations, but the lack of a clear strategy is often the primary culprit of those that fail. Ironically, to unlock the potential of digital transformation, leaders must shift their thinking to embrace a future-forward vision for their companies that is not technology-led, but rather strategy-led and technology-enabled. A strong technology-agnostic strategy is the key differentiator, while individual technologies provide a means to an end. Leadership can achieve this by aligning on their answers to three questions:

- What will the future environment of our industry look like when it has been transformed by a variety of epochal forces, including sustainability, customer-centricity and digital technology?

- What role in that new environment will enable our company to achieve its aspirations?

- How will digital capabilities enable us to assume this new role?

Understanding the Future Environment

Predicting the future is a tricky endeavor. To understand the likely shape of an uncertain future, leaders should holistically analyze ways in which digital technology will enable and accelerate a broad range of other forces to shape the evolution of the entire ecosystem in which they operate. The surest way to get this right is to use the lens of customer “jobs to be done,” inclusive not only of functional needs but also anticipated social and emotional jobs on behalf of various key stakeholders in the ecosystem. Businesses are better equipped to make educated guesses about the future when these jobs are understood in the context of their relationship to projected industry trends and scenarios.

With this understanding, leaders can then establish how they believe the creation of value will shift in this future environment as well as which value pools present the riskiest or most strategic opportunities. When done well, a future environment analysis will provide critical insights to help align on digital priorities and make the people, processes and technologies required to enact digital change much more manageable. On the other hand, companies that jump into digital transformations without first taking this critical step risk hard-coding unexamined assumptions about the future into expensive technology systems and making adaptation more difficult going forward.

Aligning Around a Strategy for the Company’s Evolution

Once leaders have aligned on the future environment, the next question requires them to extrapolate their newfound understanding into a vision for the company’s role within it. It is important to understand that vision differs from strategy in that the former lays out the “what” and the latter prescribes the “how.” Accordingly, this vision should be agnostic to the specific technology products that will be used to pursue it.

This vision should be robustly grounded in a perspective on which customer jobs represent the most compelling opportunities to deliver new value in the area of targeted growth. A portfolio of strategic opportunities can be built at the intersection of a business’s target customers and their jobs to be done and potential solutions. And digital technology will play a critical role in the solutions that unlock these opportunities.

Evaluating potential growth portfolios brings larger questions back into the frame. How important is digital transformation to the business? Can you be content to react and follow, keeping up with industry standards and relying on traditional sources of value to sustain your success? Or do you need to proactively lean in and apply digital technologies in the service of a transformed business model?

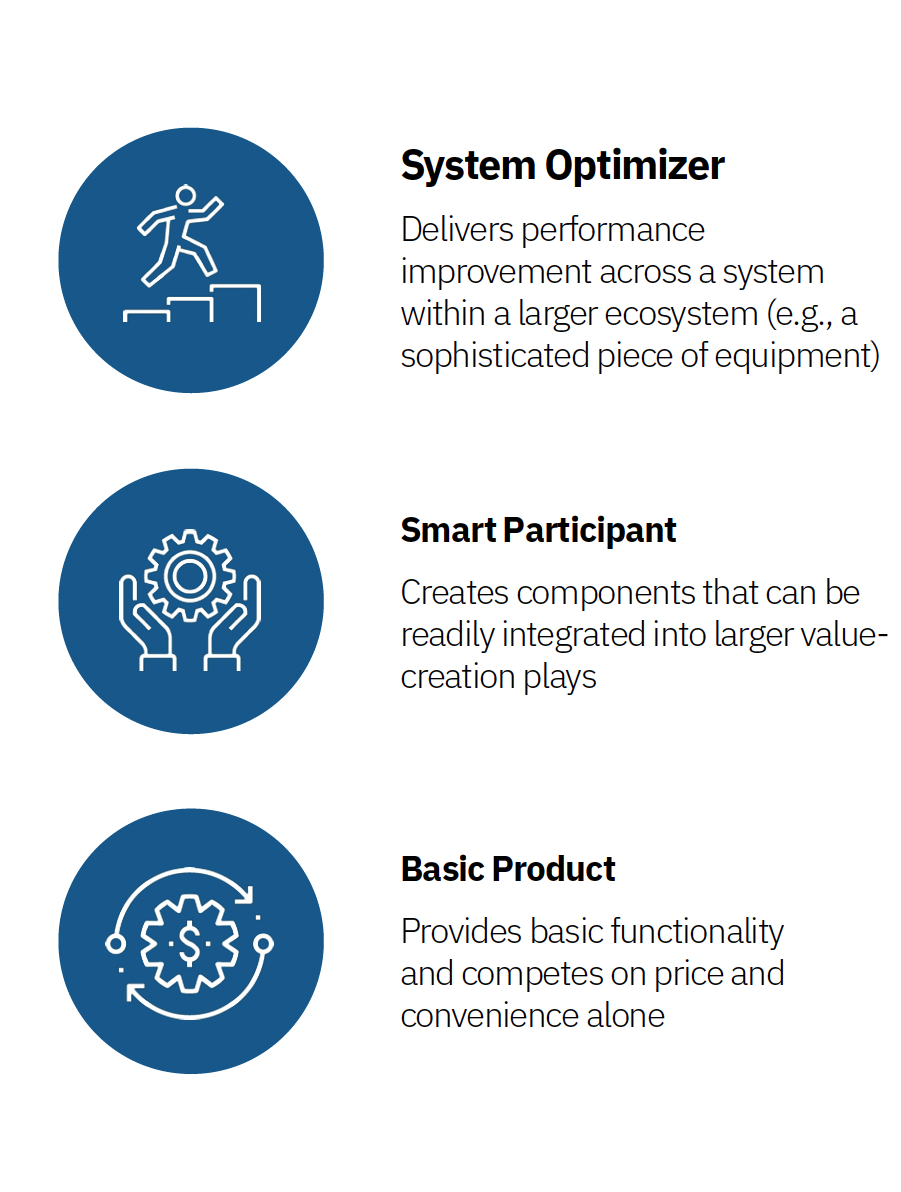

Many traditional product or material companies will have to make a fundamental choice about their future role in the ecosystem in which they participate. Will they continue to provide a basic product, allow that product to participate in the digital enablement of an intelligent ecosystem or try to play a lead role in optimizing that ecosystem? These fundamental decisions and the resulting portfolio of business opportunities lay the foundation for strategic digital prioritization.

Integrating Digital Capabilities Into a Future-Focused Strategy

A vision for an organization’s future is crucial, but not sufficient, for success in a volatile economic environment. Business leaders must also develop a concrete plan to bring that vision to life. Digital solutions are one of many enablers that can help bridge the gap between the status quo and the business’s future desired state. At this point, leaders should consider the relative business impact of potential solutions to prioritize areas of focus within a vast potential array of digital initiatives.

The challenge then shifts to connecting digital initiatives to business impact, which requires a foundational understanding of the organization’s growth objectives and should include a type of customer and a source of revenue (i.e., retention, share of wallet, or new customer acquisition). Combining this new knowledge with their customers’ jobs to be done, businesses can define exactly how they expect digital technology to advance their growth objectives. With all this context, they are positioned to determine whether they are creating something truly different or are using digital technology to simply keep up with the market and avoid deselection.

Many organizations hinge their entire evolutions on a technology implementation and consider that to be sufficient proof of digital transformation. More often than not, these companies are ill-equipped to realize gains long term because they did not take the time to lay a solid foundation for these improvements.

Digital strategy should only be conceived and executed once a clear understanding of the future environment and vision for the company’s role within it have been established.

Digital strategy should only be conceived and executed once a clear understanding of the future environment and vision for the company’s role within it have been established. The implementation of technology solutions and intelligent automation can go a long way toward improving operational efficiency. The result is cost savings that can be put toward other, more strategic, endeavors like research and development, enterprise innovation programs, or other growth-enhancing projects. Zero-based budgeting, an approach that asks businesses to build their budgets from the ground up rather than revising previous versions, is a tool that can help leaders find opportunities for strategically reallocating funds to prioritize initiatives that support the organization’s ongoing evolution.

While it can be tempting to jump headfirst into a technology implementation in an effort to modernize or differentiate the business, leaders should resist the urge. Taking the time to first develop a clear perspective on the three questions outlined above will help support organizations’ digital transformation in both the near and long terms.

KEY TAKEAWAYS

-

Think differently.

Align leaders around a shared understanding of what the future holds for the industry. -

Plan differently.

Design with the customer in mind. Deeply understand future customers’ jobs to be done and the role of digital in making progress against those jobs. -

Act differently.

Prioritize for business impact. Conceive and execute a digital strategy that is based on a clear understanding of the business impact of the capabilities in which the business is investing.