In Brief

3 ways healthcare payors and providers can alleviate friction to work better together and for the consumer

- Longstanding barriers, including outdated processes and siloed mindsets, are impeding payors and providers from working efficiently and improving patient experiences and outcomes.

- As consumer loyalty softens and disruption and regulation loom, urgency is mounting for payors and providers to rethink how they work together.

- A consumer-centric strategy and collaborative mindset will be vital to building alignment and creating a seamless healthcare experience from end to end, enabling better outcomes for patients, health systems, and insurers.

There's a push in healthcare for better collaboration between health plans and providers, but outdated business roles, processes, systems, and mindsets continue to hinder progress.

These barriers create friction, driving unsatisfactory experiences and outcomes for everyone, including the consumer, who is left to bridge the disconnect between provider and insurer.

Patient loyalty is softening as consumers seek more seamless interactions, pushing the payor-provider dynamic to the cusp of disruption and new regulation. This amplifies the urgency for payors and providers to put their differences aside to get ahead of imminent change and create a seamless experience to improve outcomes for their members and patients.

Amid a growing payor-provider movement, here are three opportunities for both organizations to work more efficiently and effectively.

1. Keep Consumers at the Forefront

Adopting a patient-centered approach requires a holistic consumer view with information, such as an individual’s health goals and needs, what they value in their healthcare experiences, what factors drive their decisions, and the social determinants that impact their health.

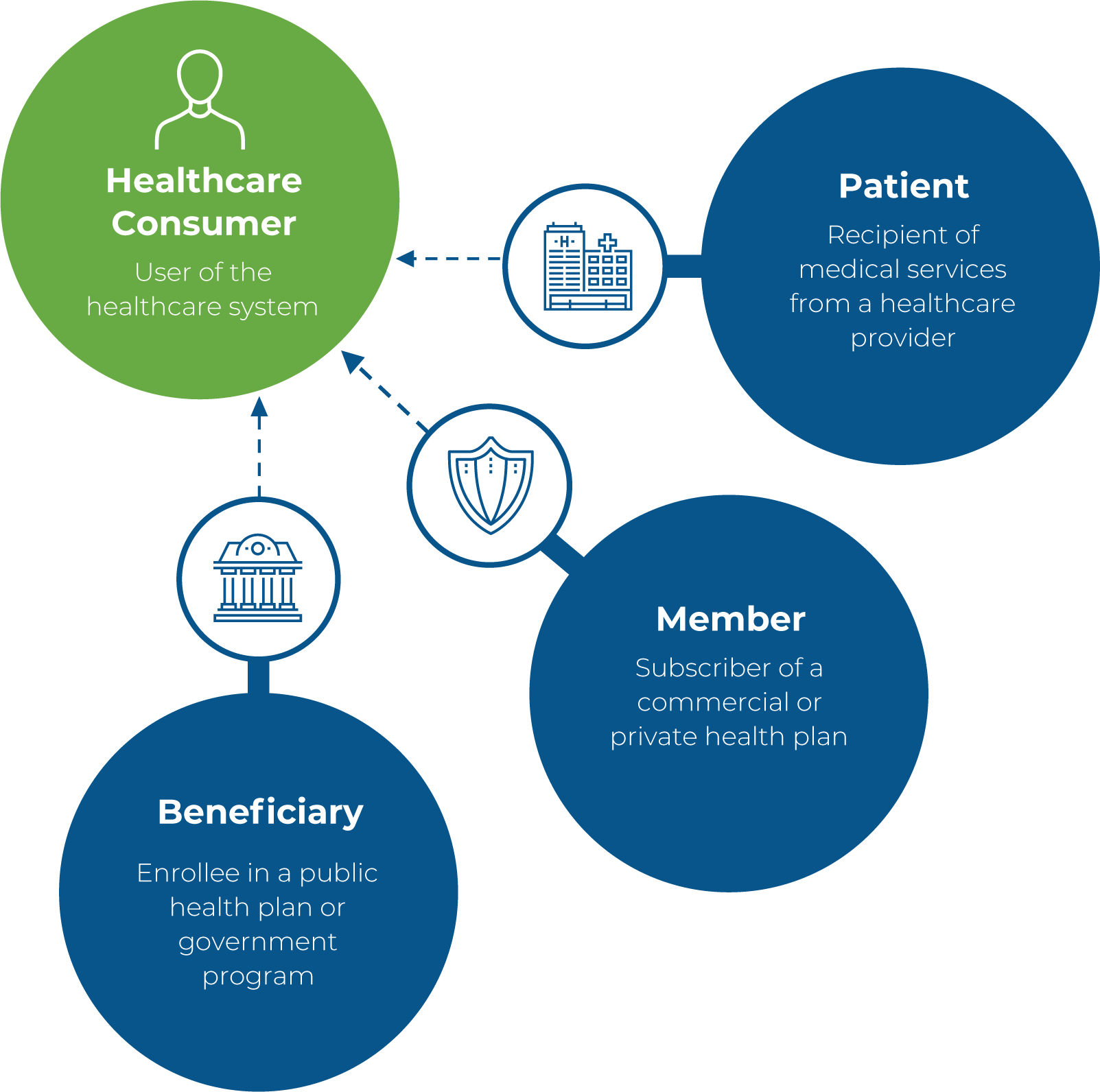

Same Person, Different Persona

Customer personas and meanings vary among healthcare entities, but ultimately, they're the same person with a shared desire: they want a positive healthcare experience from end to end.

Huron’s research finds that consumers are increasingly looking for digital options to enhance the personalization, coordination, and convenience of their care experience. More than 80% of consumers want a single point of contact for their healthcare information needs. Nearly 70% specifically want a mobile app where they can schedule appointments, check results, engage with their care team, and pay for their care.

Communication between health systems and insurers increases in importance as technologies and programs are launched to create more seamless experiences and engage consumers in their healthcare. Consumers should have a clear entry point to care and frictionless handoffs as they transition between technology and human interaction and between payor programs and their core care team.

Comprehensive consumer insights that span the entire journey will aid leaders in creating an understanding that extends beyond siloed clinical or financial information. Healthcare customer relationship management (CRM) platforms provide the functionality to view consumer data in a single, holistic view, enable timely and personalized communication, and support physician referral management programs.

2. Enhance the Patient Financial Experience

Financial discrepancies and billing ambiguity are key drivers of patient dissatisfaction. As healthcare affordability and price transparency remain front and center, forward-thinking organizations are looking beyond incremental improvements to create a consumer-centric financial experience.

Enabling this transformation requires collaboration and alignment on technology investments foundational to streamlining disjointed processes. For example, artificial intelligence models can recognize billing issue patterns, helping leaders pinpoint the root cause of discrepancies and process misalignment.

Creating a clearer, more efficient financial process that supports patients and their financial needs provides organizations significant opportunity to elevate customer satisfaction and loyalty and improve their bottom lines.

3. Adopt a Partnership Mindset

The future of payor-provider-patient relationships will be built on a foundation of open sharing of critical data. More seamless information sharing allows organizations to focus on their mission rather than exhausting resources to obtain the data they need to operate. While the interoperability rules set by the Centers for Medicare and Medicaid Services (CMS) are pushing payors and providers closer to this integration, many entities are missing the partnership mindset that will truly transform healthcare.

There is a clear benefit for payors and providers to approach their relationship as they would a partnership, taking time to understand each other’s mission, goals, and challenges to gain awareness of the forces and pressures influencing how the other operates. Leaders who can broaden their mindset and think about decisions and opportunities through the lens of all stakeholders and across the entire healthcare continuum will empower better collaboration and outcomes for patients, payors, and providers

Supporting Change

As payors and providers adopt new processes and ways of working, building alignment and gaining buy-in from leaders and staff on both sides will help generate the cooperation and engagement needed to sustain change. Data and analytics will play a vital role as organizations work toward a mutual strategy and maintain accountability and ownership of shared objectives and performance measures.