Purpose-Built Applications And Why to Use Them

It’s all too common for financial institution leaders to ask, “Why do we need more than one planning and forecasting software application?” In fact, regulators have challenged some institutions for having multiple planning engines, which inevitably generate forecast variances in some future periods.

Despite this confusion, there is a strong argument to be made for having different applications for different purposes.

Understanding the Planning Cycle

While the graphic to the right shows “budget” at the top (which many would assume is the starting position), reality is less straightforward. In a typical planning process, one step feeds information to the next regardless of where you start.

The differences across each planning phase are palpable:

- Budgeting: Budgeting (which comprises target-setting, accountability and incentive compensation) is usually a “next year” exercise that relies heavily on the most recent data as an indicator. Budgeting is designed around the balance sheet and income statement for financial institutions and includes net interest margin along with noninterest income and expense. Budgeting addresses staffing plans and capital investments, along with how much product will be generated and by whom. A budget is often set annually, and actuals are compared with the budget in subsequent months. Budgets are low level and relatively short term, usually applying to the next fiscal year.

- Forecasting: This phase involves near-term future earnings and identifying early warnings of opportunities and risks. Forecasting or reforecasting is used during the budget period when budget preparers become aware of expected changes to the numbers they set. Reforecasts are often done quarterly and sometimes monthly depending on the institution’s bandwidth.

- Asset Liability Management (ALM) Modeling: ALM modeling (encompassing interest rate risk and liquidity monitoring) is generally an entity-level process, or may even be done using a consolidation of multiple entities. The purpose of ALM modeling is to measure interest rate and currency risk, and to monitor capital adequacy and liquidity. ALM modeling involves running different interest rate and economic scenarios to measure earnings at risk (EaR) and value at risk (VaR). ALM modeling focuses on the balance sheet and net interest margin, not most of the noninterest income and expenses.

- Stress Scenario Modeling: This stage of planning includes integrated modeling of risk (credit, liquidity, interest rate, etc.), earnings and capital adequacy under various regulator-defined economic scenarios. This modeling goes hand in hand with ALM and puts particular stresses on the balance sheet, related net interest rate margin and related capital.

- Long-Term/Strategic Planning: Strategic planning is key to setting aspirational growth goals, identifying long-term opportunities and risks, and outlining future investment priorities. Strategic planning may include some high-level balance sheet and earnings targets, but usually happens at the entity or consolidated entity level and reflects upper management’s goals for the company.

Each of these planning mechanisms serves a purpose, and each can feed into another. For example, strategic goals could be the basis for evaluating and adjusting the next year’s budget. The budget, which reflects achievable balance sheet targets at a low entity level, can be rolled up to feed the ALM and stress testing models. Even outputs from stress testing models should be considered when reevaluating strategic plans.

The Case for Separate Applications

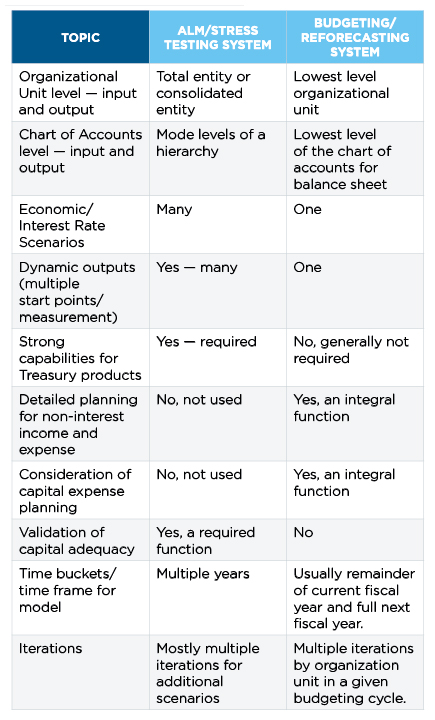

Each planning phase has distinct objectives and outputs. Knowing this, it’s understandable why financial institutions rely on distinct systems to support them. The following chart demonstrates the basic, but different, approaches taken across an ALM system and a budgeting system:

Based on these nuances in purpose and approach, it is only reasonable to use separate systems for the two processes. Yes, they should have some commonality and be aligned on certain points; this alignment happens once a year (or once a planning cycle). But in between alignment points, the short-term forecasts from each model will inevitably yield different results. The goal is to minimize those discrepancies and be able to explain why they exist.

Finding Common Ground

The most important intersection for each planning model is the starting position. All planning should begin from the position of where the institution is today. Equally important, the data for that starting point should live in a single repository that is accessible and compatible with multiple applications.

Consider these ideal points of overlap:

- Current position data should be comprehensive. This comprises all existing financial instruments (loans, deposits, investments, borrowings and assets under management). It should include the contractual characteristics of these instruments, the current status of the instruments and any known risk information for these instruments. This data foundation should be the single source of truth for all forecasting, planning and modeling applications.

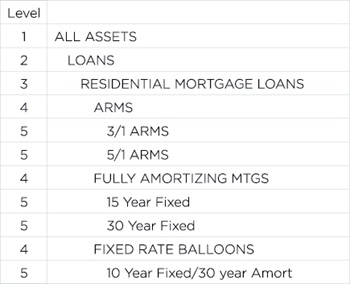

- Dimensions should be reconcilable. It’s easy to designate a single data source if all planning systems use the same chart of accounts, but it’s not a requirement. Aligning the chart of accounts between various planning systems could mean working from a hierarchy. The budget and reforecasting processes would use the lowest level of the hierarchy for planning points, while ALM and stress testing may work off a higher tier. Strategic plans could be based on an even higher level of the chart of accounts.

Planning Product Hierarchy Excerpt:

For instance, while budgeting would occur at level 5, ALM modeling could occur at level 4, and strategic planning would never go below level 3 of the shown example. However, because each planning mechanism uses the same hierarchy, the beginning position data can be reconciled. A similar approach may be taken on other dimensions, such as organizational unit. Budgeting would be at the lowest level, ALM might be at a line of business level (i.e., a rollup of multiple organizational units), and strategic planning would be at a total legal entity perspective.

- Most likely rate scenarios should be consistent. Each type of forecasting involves forming an opinion about the most likely interest rate scenario for the forecast periods. Budgeting will use only a single rate forecast, which should align with the most likely rate forecast used in ALM and stress testing.

- Prepayment assumptions should be aligned between models. If various planning models are based on the same chart of accounts, it should be simple to use the same prepayment assumptions. If ALM modeling is done at a higher chart of accounts level, minimal testing can help align the lower-level prepayment assumptions with the higher-level chart of accounts to arrive at a similar rate. These assumptions would have to be reviewed periodically to ensure accuracy.

- New business assumptions should be in sync. These would primarily center on what new business added looks like contractually (e.g., the maturity and payment structures of new business along with new business pricing). Again, if these assumptions are determined in the budget or forecast at a lower level than they are modeled in ALM, an algorithm could aggregate the information to maintain consistency.

Each type of planning a financial institution conducts has a specific purpose. For many of these functions, there are solutions designed to help the organization perform that unique type of forecasting. Institutions should not be afraid to explain to regulators that they have multiple forecasting applications for different purposes.

Forecasts are created at different levels and serve different masters within and outside the organization. Attempting to rig ALM or budgeting tools into something they’re not is futile, not to mention a resource drain. By embracing the role each application plays in the process and making small changes to create common ground between them, financial institutions can put an end to planning confusion.