What you'll learn

Keep reading to learn how to:

- Identify common lead-to-cash challenges facing PBS firms today

- Unlock agility and efficiency through composable system architecture

- Leverage Workday and Salesforce as anchors in a modular tech stack

- Apply composable strategies across industries like consulting, staffing, and construction

- Partner with Huron to align technology with long-term business outcomes

Professional and business services (PBS) firms are navigating a period of accelerated transformation. Evolving client expectations, rapid technology shifts, and intensified pressure to manage talent more effectively are reshaping how firms must operate. Amid the complexity across professional services sub-industries, defining the right lead-to-cash system architecture is essential.

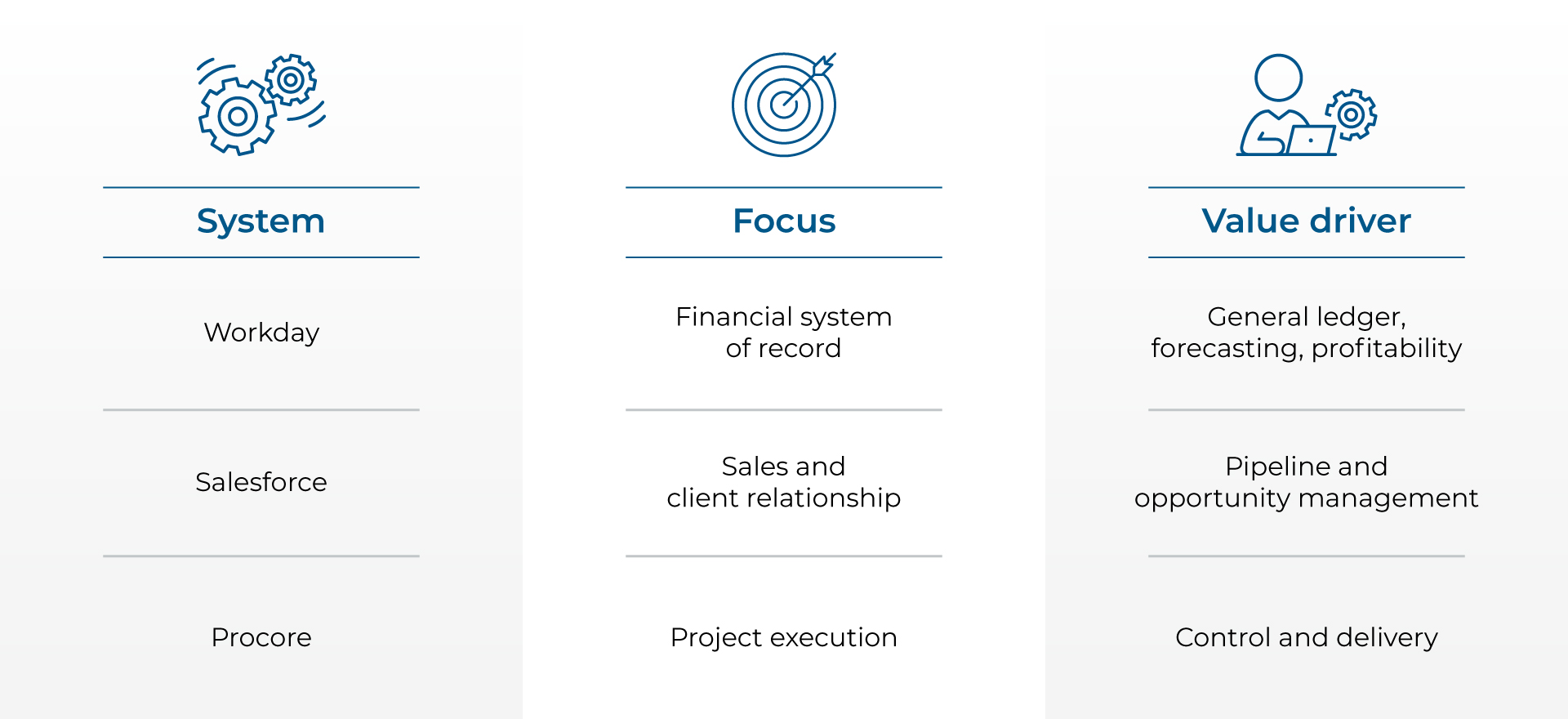

To stay competitive, leading firms are shifting to a composable lead-to-cash architecture — a modern, modular approach that delivers agility, scalability, and efficiency. Leveraging foundational platforms like Salesforce and Workday, while incorporating industry-specific solutions, allows organizations to streamline processes while solving for unique operational requirements.

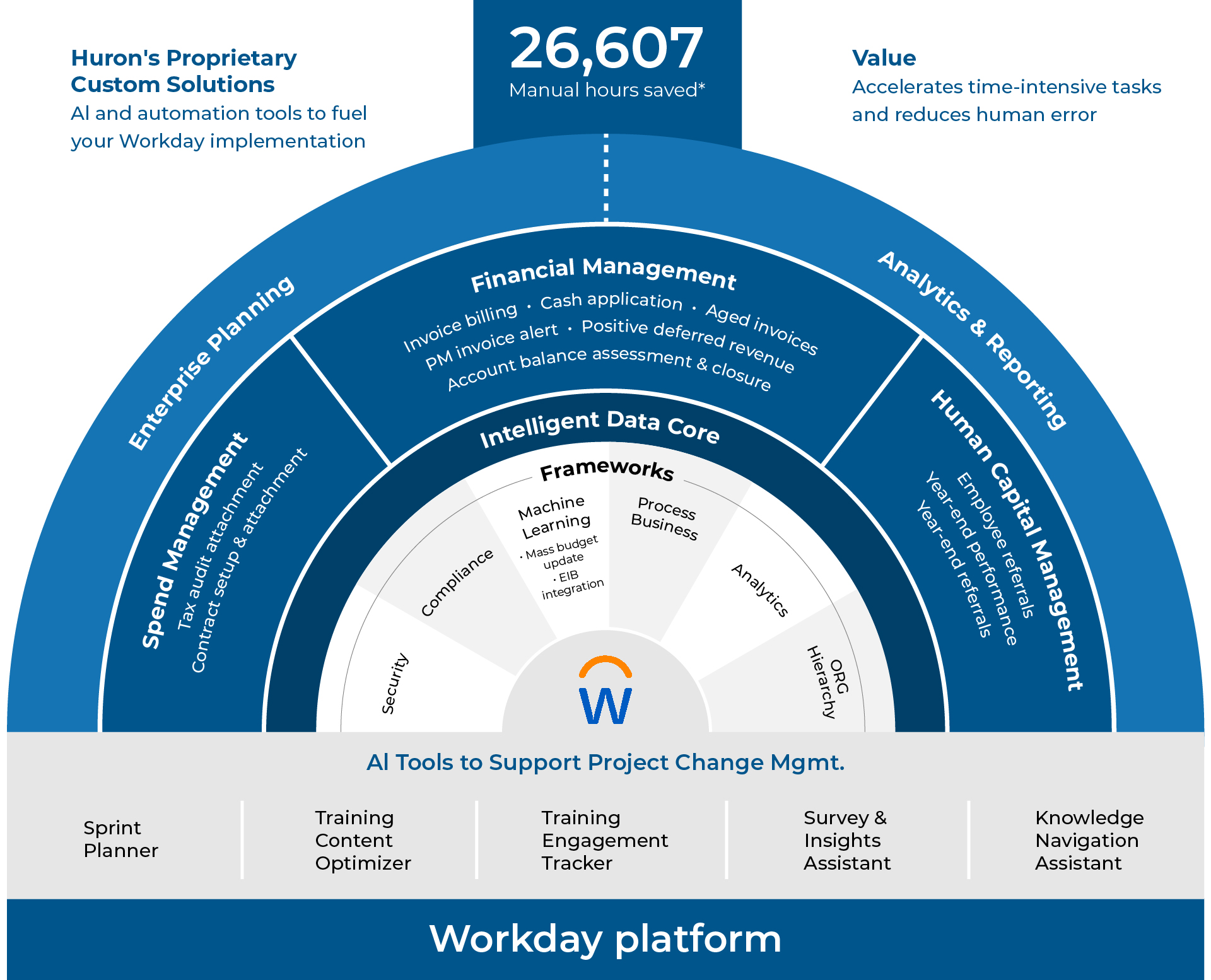

By activating Workday capabilities — including financials, human capital management, and professional services automation — and using tools like Workday Extend, Workday Prism, and Workday Accounting Center within a composable framework, PBS firms can achieve scalable flexibility, tailored customization, and responsiveness to client and market dynamics.

What we hear in the PBS market

Fragmented processes and systems

- Disconnected tools result in inconsistent or incomplete data across the lead-to-cash process.

- Manual data transfers between systems increase both error rates and operational costs.

Ineffective cross-system analytics

- Siloed booking and revenue data weakens forecasting and strategic planning.

- Sales lacks a unified view of customers, limiting effective reporting and engagement strategies.

Challenging acquisition integration

- New acquisitions introduce disparate tech stacks, straining legacy integration models.

- Supporting incompatible systems requires additional full-time employees (FTEs), driving up cost and delaying time to synergy.

76% of respondents have heard of composable ERP and 84% of this group are expected to make investments in composable ERP in 2023.” - Intelligent CIO

The strategic impact of composable system design

A composable architecture enables PBS firms to modernize their core operations while maintaining industry relevance. The benefits go beyond technology to support strategic transformation by enhancing operational agility, accelerating value realization, and elevating client delivery.

Enhanced operational efficiency:

Modular integration: Assemble system components based on business needs, reducing disruption and enabling easier updates.

Process automation: Automate manual tasks to boost accuracy, speed, and productivity and drive down operational costs.

Increased adaptability:

- Scalability: Quickly scale components to align with changing business conditions.

- Customization: Use capabilities like Workday Extend, Prism, and Accounting Center to develop tailored applications within the Workday environment that enable firms to stay nimble and aligned with business priorities.

Faster time to value:

- Pre-integrated tools: The Workday API-first approach accelerates deployment and reduces custom integration overhead for leading systems such as Salesforce, Bullhorn, and Procore.

Improved client delivery:

- Client-centric solutions: Modular design enables organizations to tailor services around specific client expectations, thereby enhancing satisfaction and retention.

- Agile implementation: Firms can make targeted system enhancements without large-scale disruption, keeping projects on time and within budget.

Industry-specific applications

Management consulting and information technology (IT) services

For project-based firms, agility and margin management are paramount. Integrating Salesforce and Workday in a composable framework enables:

- Dynamic project billing, resource allocation, and profitability analysis

- Alignment between sales and delivery teams to support accurate pricing and real-time demand planning

- Enhanced forecasting by linking pipeline, project, and financial insights that support confident executive decision-making

This integration reduces friction, improves margin transparency, and allows firms to scale while meeting diverse client expectations.

Staffing

In the high-volume, compliance-heavy staffing industry, modular architecture supports:

- Seamless integration of time tracking, ATS, payroll, and financials—reducing errors and administrative effort

- Scalability to manage 1099s, hourly workers, and complex pay cycles

- A unified system connecting Bullhorn ATS with Workday HCM, PSA, and Financials—powering faster placements, accurate billing, and improved talent experiences

Composable architecture helps staffing firms move from fragmented systems to a cohesive, data-driven growth engine.

Engineering and construction (E&C)

E&C firms require flexible control over project delivery, costs, and contracts. A composable system enables:

- Precision in job costing and financial tracking across complex, multi-phase projects

- Integration of Workday Projects and Financials with construction management tools like Procore—ensuring alignment from field operations to financial reporting

- Scalable systems that adapt to shifting project portfolios, enabling agility, accountability, and margin protection

Sometimes you need outside help to come and help look and review the processes you have and consult, give best practices on other things they’ve seen in the industry to help make everyone’s life easier.”

Key systems

Professional and business services firms looking to future proof operations should embrace a composable lead-to-cash architecture. Built on robust platforms like Workday and Salesforce, this approach supports seamless adaptation to evolving market needs, talent dynamics, and client demands. This strategy also allows firms to customize these technologies to their unique operational models, reduce risk, and accelerate time to value, achieving scalable growth and long-term competitive advantage.

Why Huron?

A successful transformation requires more than technology implementation; it demands deep understanding of industry challenges across systems, teams, and organizational priorities.

Huron brings:

- Industry-specific knowledge to tailor solutions for complex environments

- Proven Workday expertise in financials, human capital management (HCM), and professional services automation (PSA)

- Advisory and implementation capabilities across the full lead-to-cash spectrum

- A long-term partnership approach focused on outcomes, not just go-lives

Let’s build a system that drives outcomes as fast as you set them.