In Brief

- A Huron analysis found that as many as 370 of the nation’s 1,700 private nonprofit degree-granting colleges and universities could face financial exigency by 2035.

- Strategic partnerships, including mergers and acquisitions, offer struggling institutions the opportunity to preserve their missions, protect their assets, and sustain the well-being of their communities.

- Now is the time to build a partnerships marketplace that connects financially challenged and financially solvent institutions to promote institutional resilience and shape the future of higher education.

The problem is we have too many seats in too many classrooms and not enough prospective students to fill them. Over the next decade, we’re going through a very painful but necessary rebalancing in supply and demand.”

-Peter Stokes

In 2024, just over four million undergraduate and graduate students were enrolled at private nonprofit colleges and universities in the United States. Within the next decade, nearly half of them could have their education disrupted by the growing financial pressures facing their institutions.

While these circumstances demand swift action from colleges and universities facing financial exigency, they should also prompt financially stable institutions to reconsider their strategic options in a fundamentally changing landscape.

Between 2020 and 2025, approximately 100 private nonprofit colleges and universities closed or merged with other institutions, affecting nearly 200,000 students and more than $2 billion in endowment assets at the time of closure or merger announcements. To shed light on available paths and help reshape outcomes, Huron analyzed more than a decade of data to develop a model with some predictive potential.

As Peter Stokes shared with Bloomberg, “The problem is we have too many seats in too many classrooms and not enough prospective students to fill them. Over the next decade, we’re going through a very painful but necessary rebalancing in supply and demand.”

Turning financial pressure into strategic momentum

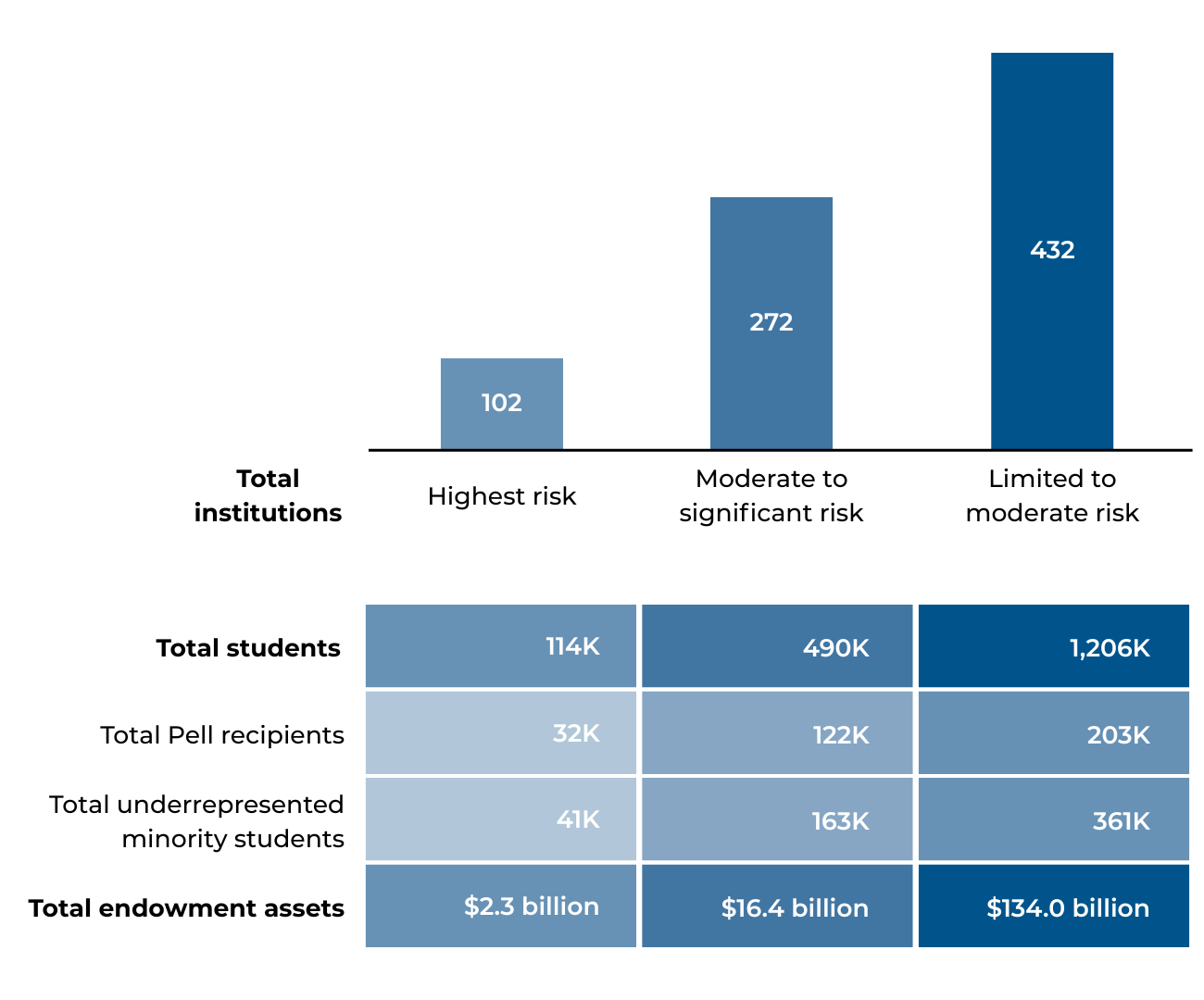

Analysis of more than 10 years of financial and enrollment data from closed and merged institutions indicates that, within the next decade, as many as 370 of the 1,700 private nonprofit degree-granting institutions, representing 600,000 students and $18 billion in endowment assets, will arrive at the cusp of financial exigency.

Another 430 institutions with over 1.2 million students and $134 billion in endowments will face moderate existential threats. Some may decline rapidly: 12% of institutions with financially stable positions as of fall 2022 IPEDS reporting began showing signs of distress, and in some cases, closed just one year later.

The oncoming disruption will be challenging, but it need not be devastating. Strategic partnerships, including mergers and acquisitions, provide struggling institutions with a means to shape the fate of their missions, the disposition of their assets, and the well-being of their communities. Institutions with the runway to execute a thoughtful partner search can leverage their assets to secure an orderly teach-out and a range of commitments to mission, legacy, faculty, staff, and alumni.

While partnerships are not simple, operationally, legally, emotionally, or otherwise, they potentially represent one of the most effective tools for struggling institutions to successfully confront today’s environment. That means as many as 800 institutions, representing 1.8 million students and $152 billion in endowment assets, could soon be exploring partnerships, as shown below.

Distribution of risk factor ratings

Source: Huron analysis

Seizing the advantage in a nascent marketplace

Financially stable institutions that learn how to navigate this marketplace will play a pivotal role in shaping the future of higher education, while bolstering their own institutional resilience.

Already, universities such as Northeastern and Villanova have generated hundreds of millions of dollars in net-new revenue and assets through a handful of strategic acquisitions. Smaller institutions, including Mercy University in New York and Clark University in Massachusetts, have gained valuable new programs through partnerships with neighboring schools that closed. In doing so, they ensured the preservation of unique programs and continuity for students.

By drawing on lessons from other nonprofit industries, such as healthcare, where mergers and acquisitions have long been a strategic tool, these institutions are demonstrating what a functional marketplace for strategic partnerships in higher education might look like: a platform for the coordinated exchange of institutional assets for commitments to mission, legacy, and community.

Despite its potential value, such a marketplace does not yet exist. Leaders frequently lack basic information to make informed decisions about partnerships, and unforced errors disqualify too many institutions from meaningfully engaging with opportunities. One of the most common and costly mistakes is not using time effectively: either spending too much of it on the wrong opportunity or leaving too little to pursue the right one.

In the worst cases, institutions lose solvency before completing a partnership and have no option but to close. In other cases, institutions fail to appreciate the runway required to bring along key constituents, such as the board of trustees, and ultimately succumb to resistance that could have been overcome with more prompt action.

Time is of the essence for the 800 institutions that serve 1.8 million students and steward $152 billion in endowment assets — and their potential partners. Leaders who invest in navigating the emerging marketplace for partnerships will have rare access to transformational opportunities. And the more leaders that do so, the better off our students will be.